Private equity investments were featured prominently in a recent article about the Pennsylvania State Teachers Retirement system. The article discussed legal action against the trustees of the fund, and specifically cited the reliance of the fund’s investment portfolio on illiquid and high-fee alternative investments such as private equity. This story could give investors pause to re-examine their motivations for investing in private equity in the first place, especially given the amount of new capital flowing into the asset class .

In our minds, there are three reasonable, economically-based reasons to invest in private equity. At the same time, the main reason cited by investors for their allocations to private equity (high return expectations) is, in our view, substantially weaker. Naturally, we conclude that investors should focus on portfolio solutions that match the good reasons, and find solutions that best manage their costs and risks.

As is well known, private equity valuations occur less frequently than comparable portfolios of publicly traded companies. This feature of private equity means that reported fund returns are smoothed over time. Consequently, these reported private equity returns appear less volatile than public equity returns, as is illustrated in Exhibit 1. The exhibit compares the realized unsmoothed and smoothed returns to the Navega US Liquid Private Equity Proxy portfolio, a portfolio tilted towards publicly traded small cap and value stocks. Over time, smoothing produces the same return but comes with less periodic volatility.

Some investors might have a preference for investments with smoothed reported returns. Accounting reasons could motivate such a preference. US public defined pension funds are examples of such investors. State-level balanced budget requirements coupled with statutory triggering of contributions place a premium on assets whose returns are equity-like but also appear less volatile than public equity. This feature of private equity returns could explain why the Pennsylania fund found private equity to be attractive.

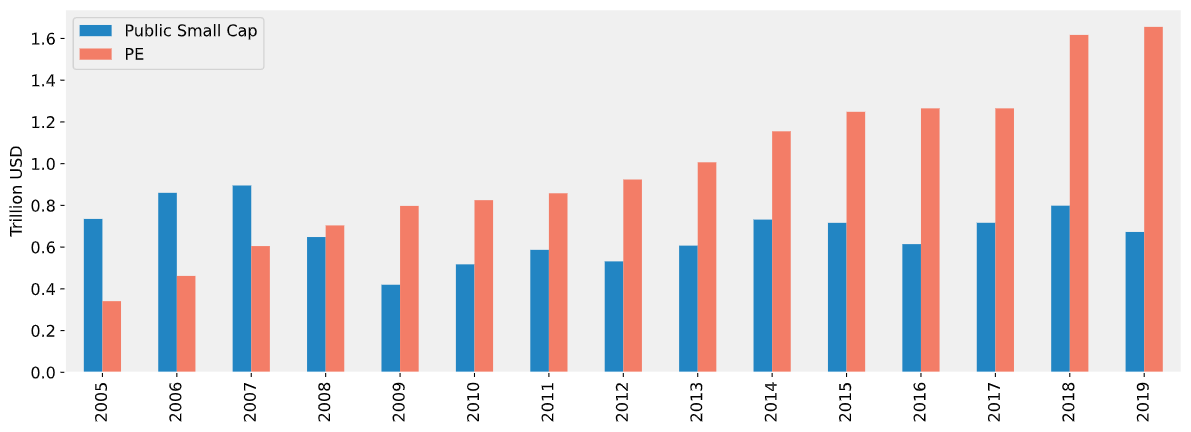

Historically, buyout funds (which is the most significant part of private equity) have tended to favor small cap and value companies. As more capital has moved into private equity, the number of publicly traded, small cap and value companies has decreased (as illustrated in Exhibit 2). Hence, the private equity market is increasingly important for those investors who want exposure to small cap and value companies as it offers greater capacity.

Investors would want exposure to small cap and value because of an expectation that the historically-observed return premium to small cap and value will persist. This premium captures the risk associated with the long-term cash-flow (earnings, dividends) exposure of small cap and value firms to macroeconomic uncertainty. Because the premium is a long-term premium, it is more appropriate for investors (e.g. public pension funds, sovereign wealth funds, family offices) who themselves have long investment horizons.

For private equity investments, leverage usually shows up in the balance sheets of the portfolio of companies: these companies can take on more debt than their public market counterparts. The benefit to the equity holder is that the increased debt load increases the potential for higher returns relative to public market counterparts. (Of course, the same principle works in the opposite direction - when times are bad, the potential for losses are higher for the portfolio of companies in private equity portfolios.)

The main reason for investors to lever is to achieve some otherwise unattainable return objective. Although investors can (potentially) borrow and invest directly in the equity market, private equity vehicles are attractive because the leverage is implicitly included at the company level. This point saves the investor from having to develop a formal policy on leverage. Leverage will be attractive to investors (such as US public defined benefit plans) with target returns that are statutorily determined and/or high and unaffected by market conditions .

In the aggregate, private equity portfolios have outperformed their public market counterparts. As discussed, part of this excess return can be attributed to a small cap/value bias, and part to leverage. What is left is the skill of the general partner in identifying and managing a portfolio of companies.

This source of return is often referred to as the manager’s alpha. The manager’s alpha is often used to justify the relatively high fees charged by private equity managers. Implicitly, part of a private equity fee is payment for leverage, smoothing and access to the small cap premium. What is left is the general partner's alpha. Since not all managers are skilled, the key for the investor is determining whether (or not) a specific general partner has skill.

On balance, whether or not the excess private equity returns experienced by a specific investor are persistently high relative to public equity depends on:

Whether the small cap/value premium persists

The ability to use leverage, and

The investor’s ability to identify skilled managers.

Investors will continue to allocate capital to private equity. As they manage their portfolios, they should consider the following questions: first, will the small cap/value premium persist? Second, do they have enough transparency into the skill of their specific investment managers? Third, can they attach prices to each of the components of private equity returns? Fourth, how do the sum of the constituent prices compare with specific private equity funds? Finally, are there low-cost alternatives that capture some, but not all, of the properties of private equity? We continue to investigate these questions ourselves and in future notes, starting with the theme of persistence of private equity returns.

This document is for informational purposes only. This document is intended exclusively for the person to whom it has been delivered, and may not be reproduced or redistributed to any other person without the prior written consent of Navega Strategies LLC (“Navega”). The information contained herein is based on Nageva’s proprietary research analytics of data obtained from third party statistical services, company reports or communications, publicly available information, or other sources, believed to be reliable. However, Navega has not verified this information, and we make no representations whatsoever as to its accuracy or completeness. Navega does not intend to provide investment advice through this document. This document is in no way an offer to sell or a solicitation of an offer to buy any securities. Investing in securities involves risk of loss, including a loss of principal, that clients should be prepared to bear. Past performance is not indicative of future results, which may vary materially. While this summary highlights important data, it does not purport to capture all dimensions of risk. The methodology used to aggregate and analyze data may be adjusted periodically. The results of previous analyses may differ as a result of those adjustments. Navega has made assumptions that it deems reasonable and used the best information available in producing any calculations herein. Statements that are nonfactual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that could be incorrect and are subject to change without notice. All information provided herein is as of the delivery date the document (unless otherwise specified) and is subject to modification, change or supplement in the sole discretion of Navega without notice to you. This information is neither complete nor exact and is provided solely as reference material with respect to the services offered by Navega. Information throughout this document, whether stock quotes, charts, articles, or any other statement or statements regarding market or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The information presented here has not been personalized, and is not based on the financial circumstances of the recipient. This information may not be applicable to your particular financial needs, and should not, by itself, be used to make determinations regarding the purchase or sale of securities, or other investment decisions.

The model performance information presented is based on the application of Navega’s factor analysis, backtested against actual historical data. “Backtesting” is a process of objectively simulating historical performance information by applying a set of rules backward in time. The results of the application of Navega’s model do not reflect actual performance or actual historical data. Such models are prepared with the full benefit of hindsight, and it is not likely that similar results could be achieved in the future.

The model portfolios were constructed by Navega with the benefit of hindsight to illustrate certain performance metrics. The performance shown was not actually achieved by any investor. The investments in these hypothetical portfolios were selected with the full benefit of hindsight, after performance over the period shown was known. It is not likely that similar results could not be achieved in the future. The hypothetical portfolios presented here are purely illustrative, and representative only of a small sample of possible scenarios.

The projections shown do not represent actual performance, and are based on assumptions which may not occur. It is possible that the markets will perform better or worse than shown in the projections, the actual results of an investor who invests in the manner these projections suggest will be better or worse than the projections, and an investor may lose money by relying on these projections.