Covid-19 naturally raises the issue of how investors can incorporate the importance of such significant shocks into their risk management processes. Practically speaking, this issue comes down to three questions. First, is this environment conducive to my bond portfolio acting as a hedge or not? Second, what does the evolution of public health policy mean for my factor overweights (e.g. small cap and value stock)? Finally, can I still expect a premium from my allocation to illiquid alternatives? Answering these questions is made more difficult by the additional uncertainty of public health policy.

Unfortunately, existing data-driven tools are unlikely to give investors immediately meaningful and useful answers to these questions. It is not because the models underlying these tools are bad, or that data-driven analytics are inappropriate. Indeed, standard risk models should form a part of every investor’s analytic tool kit. It is just that these models were designed for different business end-goals. To put this differently - when installing a screw, we usually look for a screwdriver, not a wrench.

The question for risk management in the time of Covid-19 is identifying the real source of risk, and then looking for the correct tools. Three connected ideas are helpful to framing a discussion of why standard risk models should be complemented with other analytic tools. These ideas are time horizon, structure and uncertainty.

A straightforward way to understand why time horizon matters is to link it to the underlying business decision. For example, trading desk risk managers are tasked with analyzing whether there is sufficient capital to withstand shocks to the daily valuations. By contrast, risk managers at investment management firms (e.g. mutual funds) are more worried about the impact of shocks to quarterly performance (benchmark sensitive or otherwise). Finally, the main consideration for institutional investors such as pension funds and sovereign wealth funds is whether their asset portfolios will achieve long-term objectives such as paying pension benefits. Each of these business purposes carries with it a different time horizon and potentially different sources of risk. And, because the sources of risk could be different, the demands for data-driven analytic tools will be different.

The second key idea is structure - a theoretical model of some sort embedded in the data analysis. Simply put, the analyst proposes a theoretical model that is assumed to be able to generate the observed data. These models always require that a parsimoniously chosen set of parameters be estimated from the existing data. And, the estimated parameters are evaluated in terms of how they match against the proposed theoretical model. Adding structure would seem to be relatively less important for very short horizon risk management problems, but incredibly relevant for long-term risk management problems.

Finally, we get to the idea of uncertainty. This idea traces back to the economist Frank Knight, among others. Essentially, it says that there are some phenomena where it is impossible to define, a priori, a distribution. Uncertainty stands in contrast with risk, where estimating a distribution is par for the course. It stands to reason that solutions to problems involving uncertainty cannot be addressed with standard data-driven techniques. Similarly, it makes sense that risk managers, and the decision makers they support, will need to impose some kind of structure if they want to incorporate uncertainty into their analysis.

The Global Financial Crisis of 2008-9 provided a good illustration of how uncertainty entered into asset pricing and portfolio decisions. The uncertainty issues revolved around how long it would take to return to a positive long-term trend, and whether the trend would equal the pre-crisis trend. In fact, this was the most tangible example for investors of uncertainty in action until Covid-19.

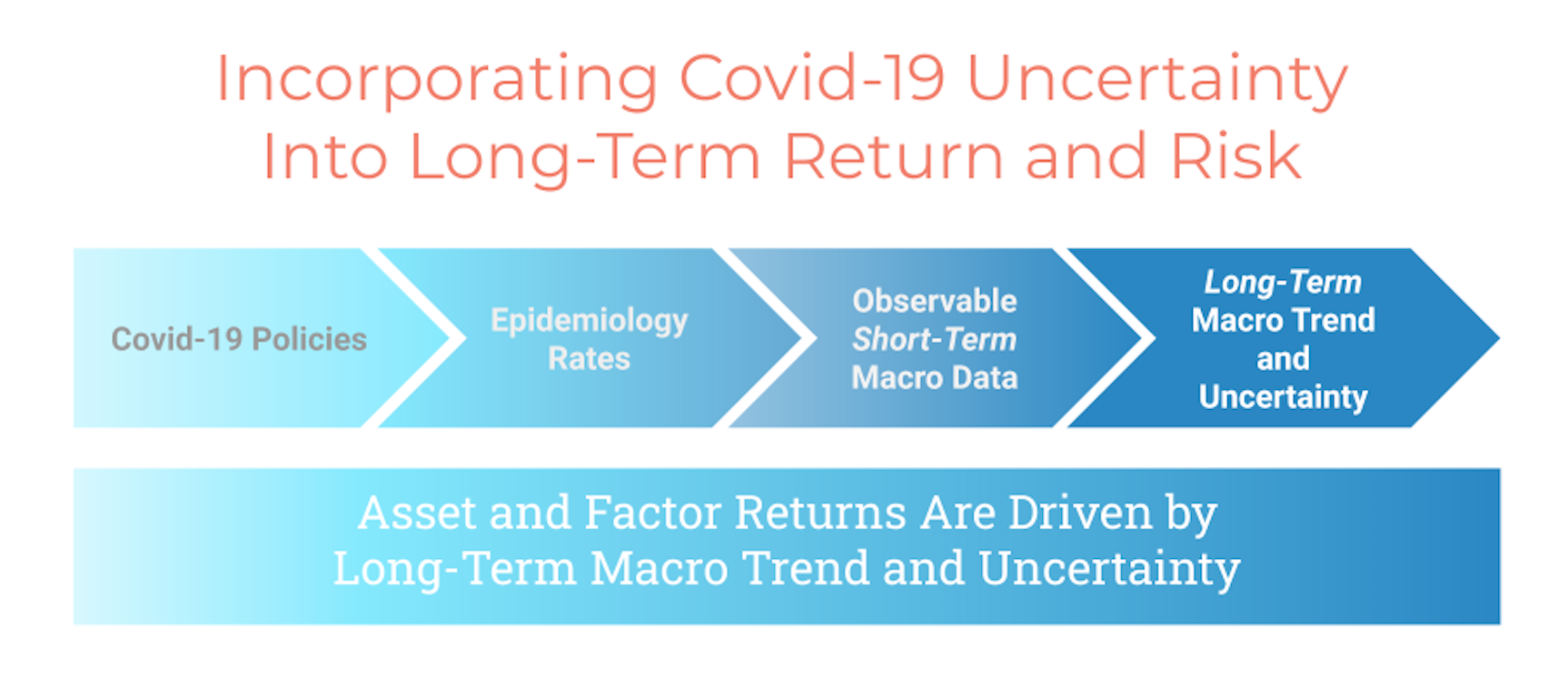

As distinct from the GFC, Covid-19 has multiple sources of uncertainty. Investors, and others, need to worry about the epidemiology of Covid-19 as well as the policy responses. Each of these has consequences for underlying economic growth and hence asset prices. Since we have no real data to represent the policy responses to pandemics, risk managers and decision makers will need to rely on other tools. And, they will need to use structural models to fully incorporate the results of these tools into their analysis and decisions.

What kinds of additional tools could investors and risk managers use? There are three complementary places to look. First, investors and risk managers should exploit models that explicitly link asset prices to macroeconomic events. Modern asset pricing models do this in a way that fully incorporates the role of uncertainty into a structure. Accounting for macro uncertainty help investors identify the systematic sources of long-term risk and return to factor-based strategies (i.e. value, small cap, quality) and illiquid alternatives. Second, investors and risk managers should make use of collective intelligence to better understand the dimensions surrounding policy uncertainty. Analysis from collective intelligence can be fully incorporated into modern asset pricing models. Finally, investors and risk managers should make use of timely economic and market data, possibly beyond what is available in the usual data releases.

Investors know that every decision carries risk. The three questions posed at the beginning are illustrations of risk-type questions where additional analytic tools are required in order to provide meaningful and useful analysis. In our view, the use of modern macro asset pricing models together with more timely publicly available data and crowdsourced information provides a step forward in addressing the uncertainties posed by Covid-19. By doing so, risk managers can provide richer analysis for investors and decision makers.

This document is for informational purposes only. This document is intended exclusively for the person to whom it has been delivered, and may not be reproduced or redistributed to any other person without the prior written consent of Navega Strategies LLC (“Navega”). The information contained herein is based on Nageva’s proprietary research analytics of data obtained from third party statistical services, company reports or communications, publicly available information, or other sources, believed to be reliable. However, Navega has not verified this information, and we make no representations whatsoever as to its accuracy or completeness. Navega does not intend to provide investment advice through this document. This document is in no way an offer to sell or a solicitation of an offer to buy any securities. Investing in securities involves risk of loss, including a loss of principal, that clients should be prepared to bear. Past performance is not indicative of future results, which may vary materially. While this summary highlights important data, it does not purport to capture all dimensions of risk. The methodology used to aggregate and analyze data may be adjusted periodically. The results of previous analyses may differ as a result of those adjustments. Navega has made assumptions that it deems reasonable and used the best information available in producing any calculations herein. Statements that are nonfactual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that could be incorrect and are subject to change without notice. All information provided herein is as of the delivery date the document (unless otherwise specified) and is subject to modification, change or supplement in the sole discretion of Navega without notice to you. This information is neither complete nor exact and is provided solely as reference material with respect to the services offered by Navega. Information throughout this document, whether stock quotes, charts, articles, or any other statement or statements regarding market or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The information presented here has not been personalized, and is not based on the financial circumstances of the recipient. This information may not be applicable to your particular financial needs, and should not, by itself, be used to make determinations regarding the purchase or sale of securities, or other investment decisions.

The model performance information presented is based on the application of Navega’s factor analysis, backtested against actual historical data. “Backtesting” is a process of objectively simulating historical performance information by applying a set of rules backward in time. The results of the application of Navega’s model do not reflect actual performance or actual historical data. Such models are prepared with the full benefit of hindsight, and it is not likely that similar results could be achieved in the future.

The model portfolios were constructed by Navega with the benefit of hindsight to illustrate certain performance metrics. The performance shown was not actually achieved by any investor. The investments in these hypothetical portfolios were selected with the full benefit of hindsight, after performance over the period shown was known. It is not likely that similar results could not be achieved in the future. The hypothetical portfolios presented here are purely illustrative, and representative only of a small sample of possible scenarios.

The projections shown do not represent actual performance, and are based on assumptions which may not occur. It is possible that the markets will perform better or worse than shown in the projections, the actual results of an investor who invests in the manner these projections suggest will be better or worse than the projections, and an investor may lose money by relying on these projections.