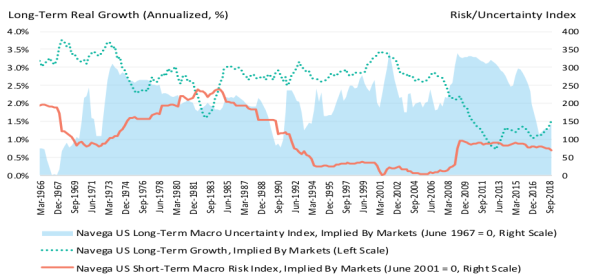

The foundation of our investment solutions is our platform. The root of any long-term solution is an assessment of the state of the economy. We use modern models from financial economics to assess the state of the economy and its impact on capital market assumptions. We use time series econometric models to provide forecasts and confidence bands for major macroeconomic variables. Since we use Bayesian models, we are able to assess the impact on our forecasts of changing the initial priors.

Economic growth, and long-term trends are critical for assessing long-term asset class and factor returns. We use an asset pricing model (based on long-run risk) to link macro conditions to capital market assumptions. The combination of the two models produces projections of the term structure of expected returns and risk. Our term structures are updated as new information about the macroeconomy becomes available.

Visit: https://macroandmarkets.com

Request access to our collective intelligence, data and analytics platform and start to develop better and more transparent, strategic investment solutions.

Request Demo